26+ Loans for low credit score

The impact of a slight credit score drop is near meaningless. What 30000 Loans Cost Over 5 Years.

Fha Loan Complete Guide On Fha Loan With Its Working And Types

Cardholders earn 5 back on Walmart purchases made online or through the Walmart mobile.

. Whats more after 45 days of payment on Flex 6 you may be eligible for a credit line increase. There could be a temporary drop in your credit score if you enroll in a debt consolidation program but as long as you make on-time payments your score quickly improves and you are eliminating the debt that got you in trouble to start. Let Bankrate a leader.

0 intro APR for 15 months from account opening on purchases. Business Loans. Make improving your credit score even more rewarding with 5 cash back on first 2000 of combined quarterly purchases in two categories like.

Credit Score Range Total Interest. Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more. For those looking at their score and wondering what is a good credit score its helpful to understand that each of the credit reference agencies has a different scoring range.

Your ongoing APR for purchases and balance transfers could be as high as 2649 variable depending on your credit. OppLoans personal loans have an APR range of 59 - 160OppLoans rates run extremely high because the lender specializes in installment loans for people with bad credit and positions itself as an alternative to payday lenders which can charge 400 or more. Having a high score makes it easier to be approved for credit cards and loans qualify for lower interest rates and get higher credit limits and loan amounts.

A credit score is primarily based on a credit report information typically sourced from credit bureaus. Earn a 200 cash rewards bonus after spending 1000 in purchases in the first 3 months. Because applying for several loans can hurt your credit score target lenders that you think.

However conventional loans are also available with credit as low as 620 and a down payment as low as 3. If your FICO score is below 580 youll need a 10 down payment. Step leverages secured loans to help your child develop a strong credit score.

FHA loans are intended for people with lower credit. What Are The Minimum Credit Score Requirements For A Mortgage In Canada 2022. Overview New Markets Loan Program Business Term Loans.

The Walmart Cards rewards rates range from 1 to 5 back depending on the type of purchase made. Big Buck Loans Best broker for low-credit borrowers. Low minimum credit score requirement.

Divorce Costs Documents Needed And Steps Involved These 26 Penny Stocks Defied Gravity To Zoom Up To 2800 In The First Half Of 2022 How Eb 5 Concurrent Filing Will Let Investors Live Work And Study In The Us. The account combines aspects of a debit card and a credit card to help your child build credit. OppLoans Rates Fees Other Terms.

If you have a low credit score consider holding off on a car purchase if possible until you. The as low as 670 credit score requirement makes the card more. Title loans first emerged in the early 1990s and opened a new market to individuals with poor credit and have grown increasingly popular according to studies by the Center for Responsible Lending and Consumer Federation of America.

Low-interest credit cards vs. Taking out a personal loan can affect your credit score in a number of waysboth good and bad. Find out the average auto loan rates by credit score how auto loan rates work and where you can get the best auto loan rates.

Prime 660 - 719 468. Repaying it in a timely manner is key to a healthy score. Low interest personal loans.

You may be able to score a lower interest rate by going with a shorter repayment. Cash Advance fee of 5 of each advance amount 10 minimum. Read reviews and recommendations from our experts on the best low interest credit cards available from our credit card partners.

DriveTime has more than 135 dealership locations in 26 states that specialize in auto loans for consumers who have bad credit. Jumbo loans may be the right option for people buying high-priced homes. These have higher interest rates than home improvement loans but a higher credit score will help lower your rate.

Most people think bad credit car loans are hard to find and that a poor credit score means you are stuck with a car that stalls as often as it starts. Your credit score is an overall picture of your ability to pay back the money you borrow. Borrowers make weekly payments over 26 weeks.

Loans insured by the Federal Housing Administration or FHA have a minimum credit score requirement of 580 although youll probably need a score of 620 or higher to qualify with most lenders. Going into 2022 the minimum credit score needed to get approved for a mortgage is 640 though it would be more accurate to say that anywhere between 620 and 680 would be considered a minimum depending on the lender. Lenders such as banks and credit card companies use credit scores to evaluate the potential risk posed by lending money to.

A credit score is a numerical expression based on a level analysis of a persons credit files to represent the creditworthiness of an individual. People with bad credit score can check out these 5 best payday loans. They are the cousin of unsecured loans such as payday loansSince borrowers use their car titles to secure the loans theres.

Not only that your credit score opens up a range of credit card options including top-tier rewards credit cards. Consider a Debt Consolidation Plan. These are as follows.

Earn unlimited 2 cash rewards on purchases. Personal loans are ideal for a one-time expense that you need a few years to repay such as a home improvement. It usually takes a very good credit score to qualify for one of these.

The variable APR for Cash Advances is 2674. Making your loan less profitable than new loans. For a personal loan or credit card aim for a score in the low- to-mid 700s.

Whether shopping on the lot or online DriveTime claims it can. 326 to 1450 with autopay Fixed APR. Consider the effects on your already low credit score.

A good credit score offers more than just bragging rights. Super prime 720 or above 365. If its above 580.

26 13 out of 5 Overall APR range. They allow a minimum credit score between 500 and 580. Low-interest credit cards and personal loans are useful in different situations.

Secured Loans Types And Features Of Secured Loans

Rivera Credit Solutions

Don T Go Bust Borrowing Useful Credit Solutions Infographic No Credit Loans

Pin On Financial Education

H1b Visa Guide How To Get An H1b Visa 2022

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Bad Credit Mortgage Loans For Bad Credit No Credit Loans

Pin By Heather C On Credit Credit Repair Business Improve Credit Improve Credit Score

Hard Money Loan Complete Guide On Hard Money Loan With Example

Commercial Loans Complate Guide On Commercial Loans In Detail

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

Short Term Loan Types And Examples Of Short Term Loan

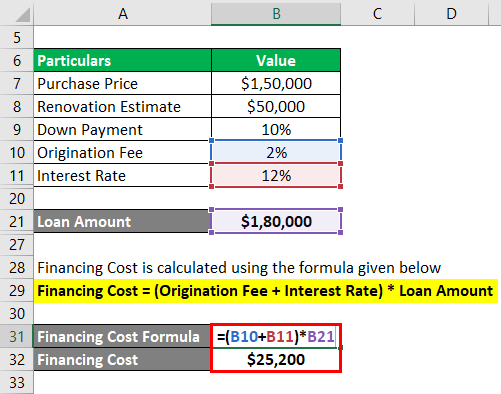

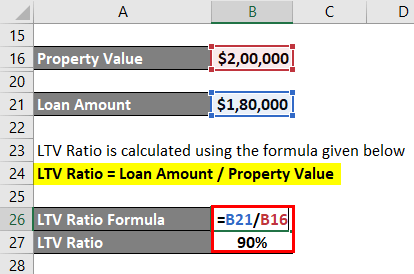

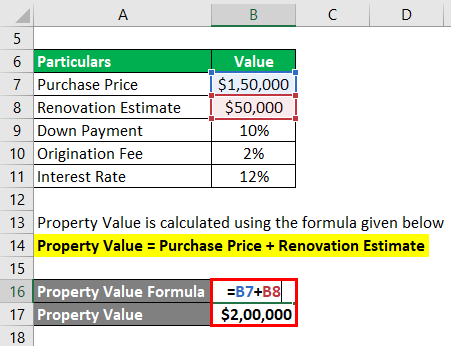

Hard Money Loan Complete Guide On Hard Money Loan With Example

Hard Money Loan Complete Guide On Hard Money Loan With Example

Rivera Credit Solutions

Hard Money Loan Complete Guide On Hard Money Loan With Example

Rivera Credit Solutions

Know What Credit Score Level Is Required To Get Any Loan Credit Score Good Credit Free Credit Score